Palomar Holdings, Inc (PLMR)

Palomar's Offshore Debt Empire

Update: May 18, 2025

Executive summary

A very big part of Palomar's business takes place in an obscure offshore company (SPV) whose activities are not consolidated into Palomar's publicly disclosed financial reports. This is by itself a red flag. See our original article here and “The Accounting Trick Behind 30 Years of Scandal”.

That offshore company has now borrowed $1.145 billion, which is an enormous amount when compared to Palomar's above-board business.

If the the offshore company were to be consolidated into Palomar's financial statements, the sheer size of the SPV debt would probably have a massive negative effect.

What the 10-K's say

Palomar reports its operations to the public via reports to the SEC (Securities and Exchange Commission), the so-called 10-K's. Palomar's 10-K's, have typically been well over 100 pages long in recent years. But the massive borrowing is typically relegated to a single paragraph within the 100+ page report. And that paragraph has been less-than-enlightening:

“In addition to reinsurance purchased from traditional reinsurers, the Company has historically incorporated collateralized protection from the insurance linked securities market via catastrophe bonds.” source: Palomar Holdings, Inc. 10-K 2024 p110

Nowhere is there any mention of “borrowing” or “debt”. Nor is there any mention of where the borrowed money went.

What Really Happened?

Palomar borrowed $895 million between 2021 and 2024. In 2025, they borrowed an additional $250 million to bring the total to about $1.145 billion.

The borrowed money is NOT shown in the financial statements in Palomar's 10-K reports. Nor is it shown in Palomar's reports to state regulators.

The enormous debt liability associated with the borrowing does NOT appear on the financial statements in Palomar's 10-K's. Nor is it shown in Palomar's reports to state regulators.

How could all this debt be hidden? Answer: By creating shell companies in offshore secrecy jurisdictions (Singapore and Bermuda). Palomar arranged that the offshore shell companies issue the debt securities. The offshore shell companies are a special type of company, so-called SPV's (special purpose vehicles). Palomar says these SPV's are “special reinsurance vehicles”. But the truth is that they are massively debt-funded entities with little or no resemblance to a conventional insurance company. Probably the most attractive feature of these SPV's to a corporate borrower like Palomar is that their activities are almost completely hidden from everyone but the insiders who created them.

The Debt Offerings

Palomar borrowed the money by four major debt offerings beginning in 2021.

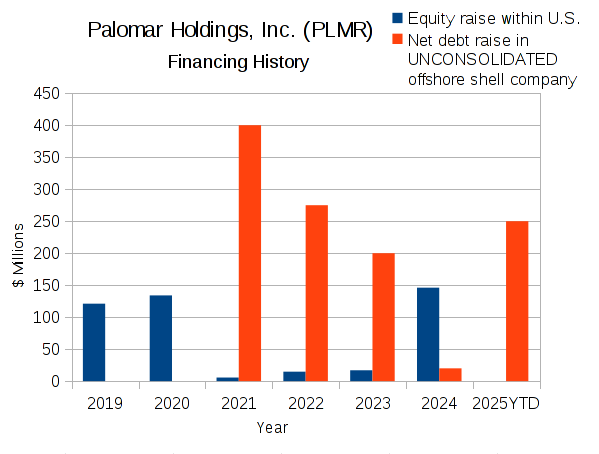

Probably the most important point raised by our previous article was that the amount of debt raised in the unconsolidated offshore shell companies was huge. The below chart shows it visually.

Do

other insurance companies borrow money on this scale?

The short answer is: no.

Historically, insurance companies have been funded by EQUITY, NOT DEBT. Some insurance companies do have debt on their balance sheets. But there must be “policyholder surplus” to backup obligations to pay claims to policyholders. “Policyholder surplus” is EQUITY the insurance company owns after deducting all its liabilities.

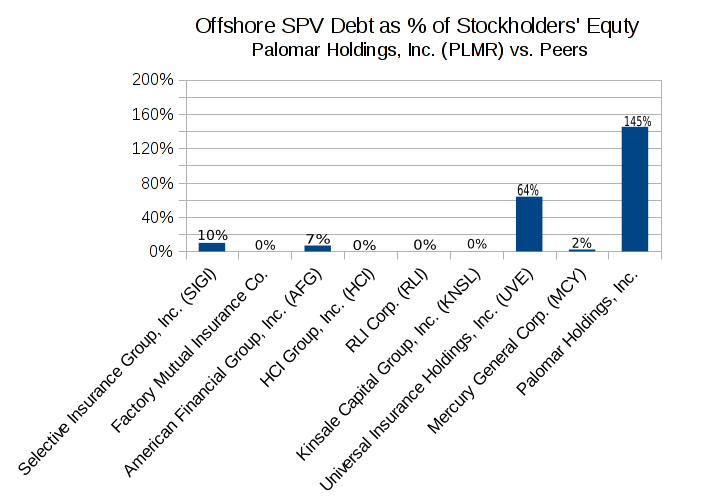

Catastrophe bonds (“cat bonds”) are debt securities, not equity. They are used overwhelmingly by companies that insure catastrophe risks such as earthquakes or hurricanes. So insurance companies that cover only non-catastrophe risks such as auto insurance generally don't issue cat bonds. But even companies that insure catastrophe risks have not borrowed to the extent that Palomar has. The below chart shows estimated cat bond debt levels for various insurers.

What

happens to the borrowed money?

If you read the promotional articles on the internet, you would think that the borrowed money from cat bonds just sits in a bank account under the watchful eye of a trustee. In reality, it is quite difficult to track cat bond debt proceeds due the the deep secrecy that surrounds it.

I have looked at some clues regarding where cat bond money ends up in the real world. I looked at records available from the Singapore government for 16 SPV's. The records indicate that 14 of those 16 invested the debt proceeds in equities. “Equities” mean the stock market. The other four invested in an combination of equities (stocks) and bonds.

Does that surprise you? I would suggest that it is naïve to believe that the insurance company executives that raise billions of dollars would leave it as “dead money” sitting in a bank account or low interest investment.

Who pays the interest on the borrowed money?

The short answer: Palomar does. “Palomar” means Palomar's shareholders.

Palomar has recently paid the following amounts to its SPV:

|

|

2024 |

2023 |

2022 |

|

Paid to offshore SPV |

$55.3 million |

$42.7 million |

$28.3 million |

|

As % of net income |

47% |

54% |

54% |

Who benefits from the borrowed money?

Palomar's debt offerings created a pool of capital amounting to at least $1.1 billion. That pool of capital has tremendous potential to earn money. The S&P 500 gained +53% in 2023 and 2024. A $1.1 billion investment in a S&P 500 index fund in those years would have earned about 53% x $1.1 billion = $580 million.

Palomar shareholders should be getting the benefit of those earnings. But there is no evidence they are getting any benefit at all.

Who owns the SPV?

You would think that the owner of the SPV would benefit from the SPV's investments. But the identity of the owner (equity holders) is a secret. My research into Singapore SPV's does indicate that whoever contributes the initial equity to a cat bond SPV typically pays almost nothing for it. The end result is that whoever owns any given SPV has effectively zero “skin in the game”.

Who does have “skin in the game”?

First, the cat bondholders. They have lent over a billion dollars to an offshore shell company that has unknown equity. Its equity is likely to be dwarfed by its debt.

Second, Palomar shareholders. Each year they are paying an amount equal to about ½ of their net income to the SPV

Meanwhile, the SPV owner, while taking very tiny risk, appears to be getting technical control of assets that could be worth over 1,000 times his equity in the shell company.

Does Palomar get reinsurance from the SPV's?

Palomar claims that the offshore shell companies (SPV's) reinsure Palomar. It is widely known that reinsurance can provide benefits to the reinsured, or it can provide no benefit at all. It depends on the terms of the reinsurance contract. Alas, the contractual arrangements between Palomar and its offshore SPV's are secret. This is despite the fact that the amount of money involved is huge in comparison to the assets in Palomar's above-board business.

In the case of Palomar's SPV's there is no evidence that any of its SPV's has ever paid a claim to Palomar.

In any case, cat bonds, and the SPV's that issue them, generally do not have a good track record of paying claims.

“Special purpose vehicles, also referred to as special purpose entities (SPEs) or variable interest entities, began outside of the insurance industry and have a less-than-savory pedigree.” source: https://www.captive.com/articles/special-purpose-vehicles-(spvs)-defined

“These special vehicles were ... 'entwined in the failure of one of the nation's largest life insurers—and the world's largest investor in junk bonds—First Executive Corporation.' SPEs were also implicated in the collapse of Enron Corporation and the more recent mortgage market collapse of 2006–2008 . . . .” ibid

“Lehman's failure in late 2008 threw the [cat bond] market into chaos, prompting a freeze in new issuance that lasted several months, because the ill-fated bank had played a counterparty role in several cat bonds.” source: https://www.reuters.com/article/us-catbonds-collateral-analysis/cat-bond-market-develops-new-collateral-trends-idUSTRE60P3RC20100126/

More recently, Jamaica issued a $150 million cat bond to protect against hurricane risks. But when Hurricane Beryl in 2024, a Cat 5 storm, caused massive damages to the island, Jamaica ended up getting nothing. source: https://www.bloomberg.com/features/2024-jamaica-hurricane-catastrophe-bonds/

But isn't this “collateralized protection”?

Palomar, in its 10-K's, says the cat bond “reinsurance” is “collateralized”. But it does not say what is the nature of the purported collateral. Nor is the collateral even mentioned in Palomar's state financial filings.

Historically, cat bond collateral has not always been there when it was needed. For example, in the 2008 financial crisis, it became apparent that a lot of so-called cat bond collateral had been mere promises to pay made by Lehman Brothers. In March 2009, it was reported that Lehman was expected to default on its collateral promises. The end result was that many cat bonds defaulted, despite being purportedly backstopped by collateral. source: https://www.reuters.com/article/insurance-bonds-ajax-idUSL505213920090305/

More recently, Vestoo, a cat bond exchange platform, was using letters of credit as collateral in cat bond transactions. A letter of credit is a promise to pay made by a bank or some other counterparty. In 2023, it became known that Vestoo had forged numerous letters of credit. Vestoo subsequently collapsed. When the dust settled, the three Israeli founders of Vestoo had fled to Israel. Bermuda quietly liquidated what was left of Vestoo. https://www.brownejacobson.com/insights/london-market-autumn-2023/downfall-of-vesttoo

What if Palomar consolidated its cat bond SPV?

We don't know enough details about the cat bond SPV to predict the full effect of consolidation. But it's a pretty good bet that the addition of $1.145 billion debt to Palomar's balance sheet would have a huge negative effect, given that Palomar's purported stockholder equity was only $0.79 billion as per its most recent 10-Q.

Palomar's unconsolidated offshore subsidiary (SPV) is a big red flag

An unconsolidated offshore entity is by itself a red flag. That's because unconsolidated offshore entities are notorious for being used for various untoward activities including hiding debt (as in the case of Palomar) and hiding losses. A poster child for SPV abuse in the insurance industry is AIG.

“AIG, in 1987, off-loaded some $1 billion in losses to its captive Coral Re, and then moved those liabilities to another captive, Richmond Re, when state regulators objected. Ultimately, the losses returned to AIG’s main balance sheet after regulators deemed that the captive transaction was little more than an effort to purge liabilities from AIG’s books by making them appear to be third-party reinsurance recoverables.” source: https://tomgober.com/shining-a-light-on-a-shadow-industry-captive-reinsurers/

Some years later, in the 2008 financial crisis, AIG collapsed:

“AIG was bailed out by American Federal Reserve (FED) which had to intervene on various occasions to inject the total amount of 205 billion USD.” source: https://www.atlas-mag.net/en/article/bankruptcy-of-insurance-and-reinsurance-companies-in-the-usa

Ernst & Young served as AIG's auditor prior to its collapse in 2008. Ernst & Young was also auditor for Wirecard, another high-profile fraud operation. Ernst & Young is now serving as Palomar's auditor.